US Central Bank: Long-term return on real estate investment is outperforming stock markets

In the scientific paper, The Rate of Return on Everything, 1870-2015, issued by the American central bank, the analysis of the return on long-term investment products shows that real estate investment is characterized by stability and low risk, and outperforms stock market in the long run.

Long-term return

Various investment advisors suggest that 10 to 40 % of a portfolio should consist of real estate investments. The remaining amount is proposed to be allocated in stock markets. Surprisingly, these two, mutually competing asset classes have never been compared in long-term research. The central bank study conducted over the last few years allows you to better understand the benefits of such investments and the application of the two investment strategies.

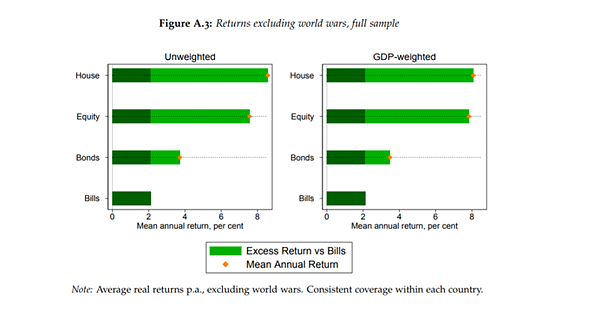

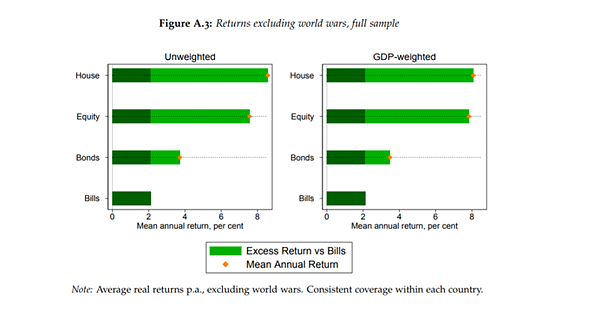

The study evaluates long-term (from 1870 to 2015) key asset classes: stocks, bonds and real estate returns. The average annual return adjusted for inflation was estimated as follows: real estate - 8%, shares - 7%, bonds - 4%.

Risk to return ratio

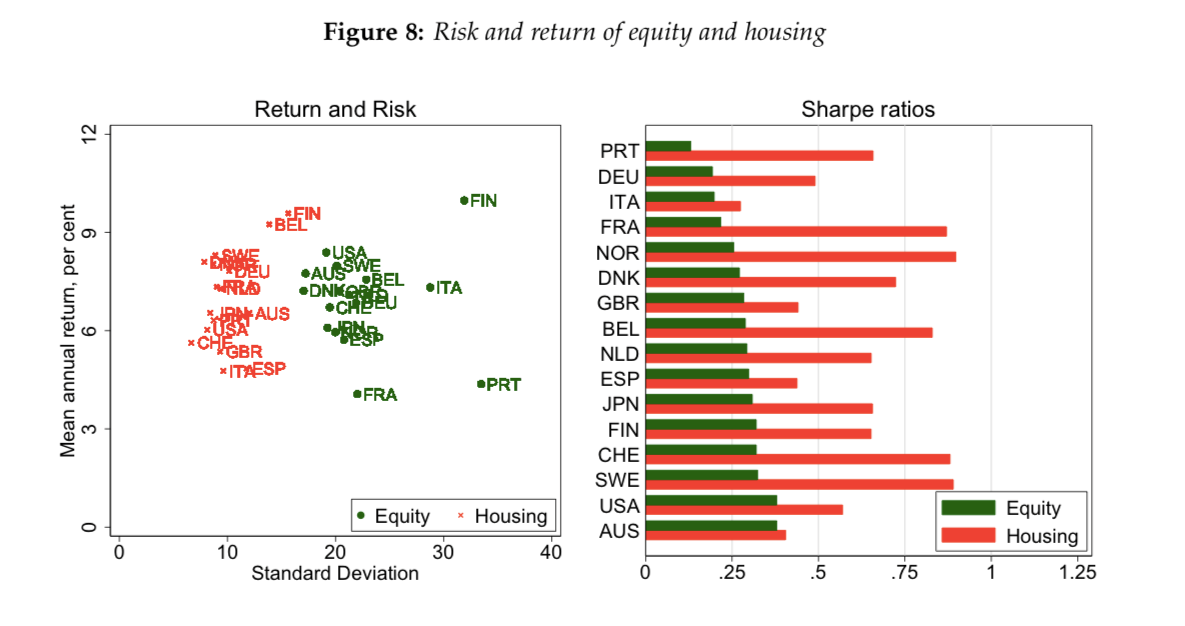

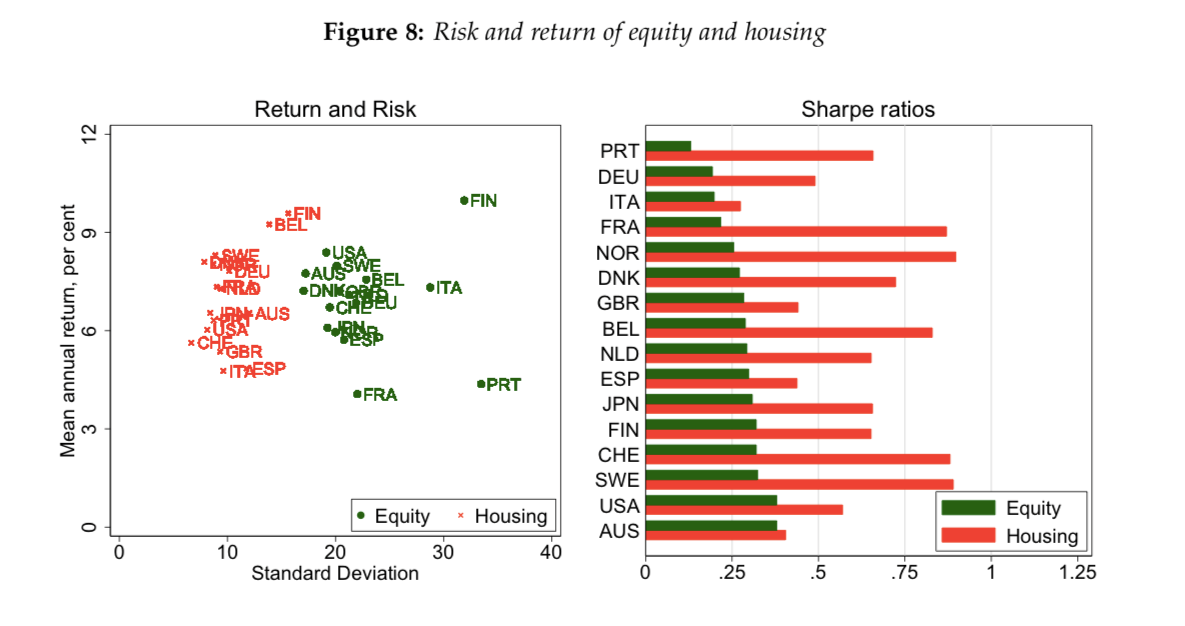

Such a result, in theory, can be explained by the popular risk-return ratio - riskier (less stable) investments enable active investors to earn more. However, when assessing return per unit of risk, it is evident that real estate is significantly outpacing shares. Risk-adjusted returns should be something that should be taken into account by investors who avoid speculation and value stability.

Why is equity risk increasing?

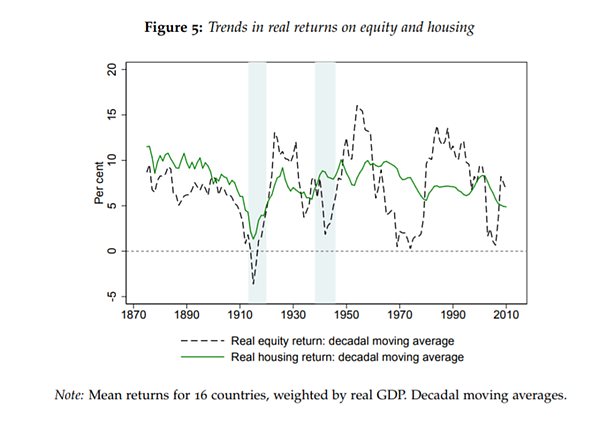

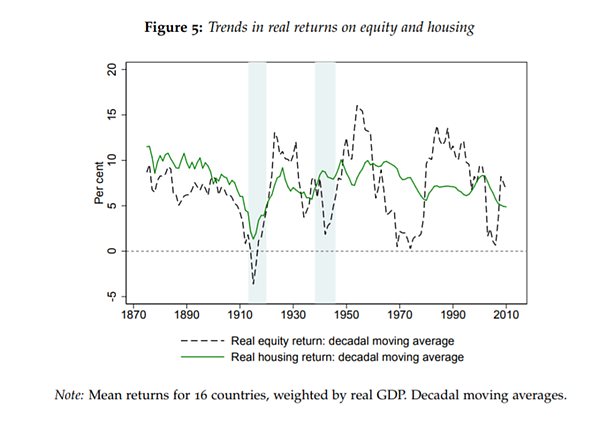

Ironically, not only globalization is the main reason for the growth of stock markets but also a major cause of rising risk. The chart shows that stock risk (returns volatility) has long been similar to real estate. A major change took place in the middle of the 20th century, after World War II, when economic unions began to develop and businesses quickly became international. With this change, companies have become dependent not only on local markets but also on remote regions. Today, changes in any of the continents affect companies around the world.

The globalization of real estate has not been heavily affected due to the inability to transport it, lower liquidity, higher transaction values ??and restorative value, which acts as a kind of "value floor". Obviously, in the long run, it becomes a valuable asset providing stability but limiting speculation opportunities.

Applicability of the study

There are practically no studies that can compare the long-term return of different products in different countries. This scientific article will make a significant contribution to the development of long-term investment strategies based on numerical data. It is likely that more attention will be allocated to real estate.

You can find entire research here: The Rate of Return on Everything, 1870-2015

US Central Bank: Long-term return on real estate investment is outperforming stock markets

In the scientific paper, The Rate of Return on Everything, 1870-2015, issued by the American central bank, the analysis of the return on long-term investment products shows that real estate investment is characterized by stability and low risk, and outperforms stock market in the long run.

Long-term return

Various investment advisors suggest that 10 to 40 % of a portfolio should consist of real estate investments. The remaining amount is proposed to be allocated in stock markets. Surprisingly, these two, mutually competing asset classes have never been compared in long-term research. The central bank study conducted over the last few years allows you to better understand the benefits of such investments and the application of the two investment strategies.

The study evaluates long-term (from 1870 to 2015) key asset classes: stocks, bonds and real estate returns. The average annual return adjusted for inflation was estimated as follows: real estate - 8%, shares - 7%, bonds - 4%.

Risk to return ratio

Such a result, in theory, can be explained by the popular risk-return ratio - riskier (less stable) investments enable active investors to earn more. However, when assessing return per unit of risk, it is evident that real estate is significantly outpacing shares. Risk-adjusted returns should be something that should be taken into account by investors who avoid speculation and value stability.

Why is equity risk increasing?

Ironically, not only globalization is the main reason for the growth of stock markets but also a major cause of rising risk. The chart shows that stock risk (returns volatility) has long been similar to real estate. A major change took place in the middle of the 20th century, after World War II, when economic unions began to develop and businesses quickly became international. With this change, companies have become dependent not only on local markets but also on remote regions. Today, changes in any of the continents affect companies around the world.

The globalization of real estate has not been heavily affected due to the inability to transport it, lower liquidity, higher transaction values ??and restorative value, which acts as a kind of "value floor". Obviously, in the long run, it becomes a valuable asset providing stability but limiting speculation opportunities.

Applicability of the study

There are practically no studies that can compare the long-term return of different products in different countries. This scientific article will make a significant contribution to the development of long-term investment strategies based on numerical data. It is likely that more attention will be allocated to real estate.

You can find entire research here: The Rate of Return on Everything, 1870-2015

Related notifications

Ready to start investing and

secure collateral for your investments?

INVEST NOW

"Trečia diena" UAB, which operates the Röntgen platform, is a licensed crowdfunding platform. The platform is governed by the EU Crowdfunding Regulation and is supervised by the Bank of Lithuania in accordance with the law.